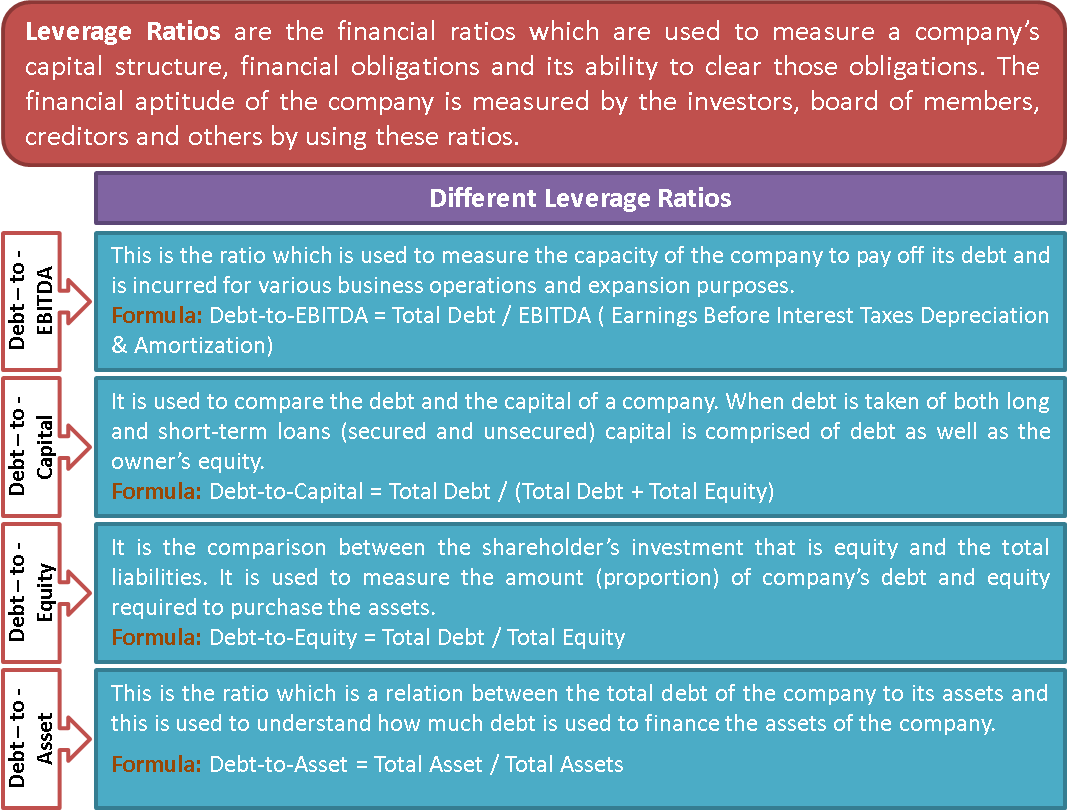

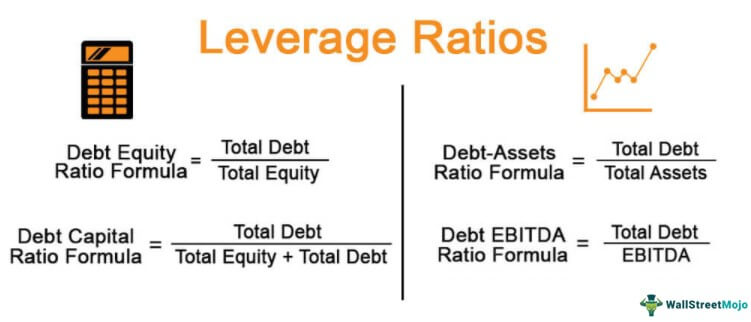

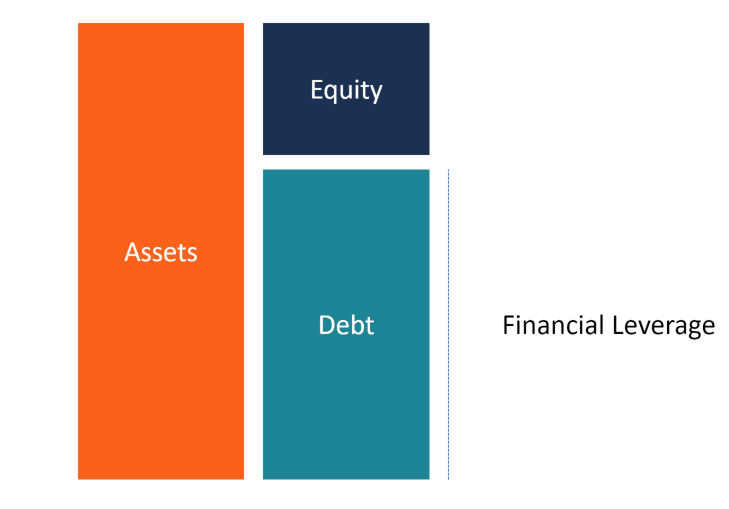

A companys financial leverage ratio shows the level of debt in comparison to its accounts such as the income statement cash flow statement or balance sheet. Financial Leverage Financial leverage is the ratio of equity and financial debt of a company.

Leverage Guide Examples Formula For Financial Operating Leverage

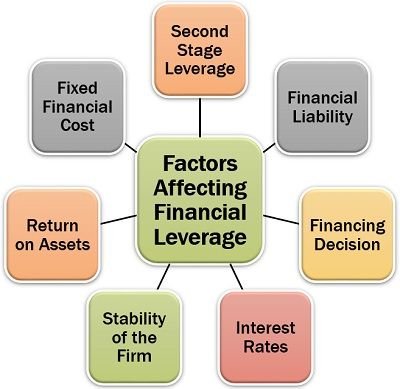

With greater debt the level of financial leverage would also increase.

What do you understand financial leverage. Financial leverage is a two-edged sword. Financial leverage is the use of debt to buy more assets. What is Financial Leverage.

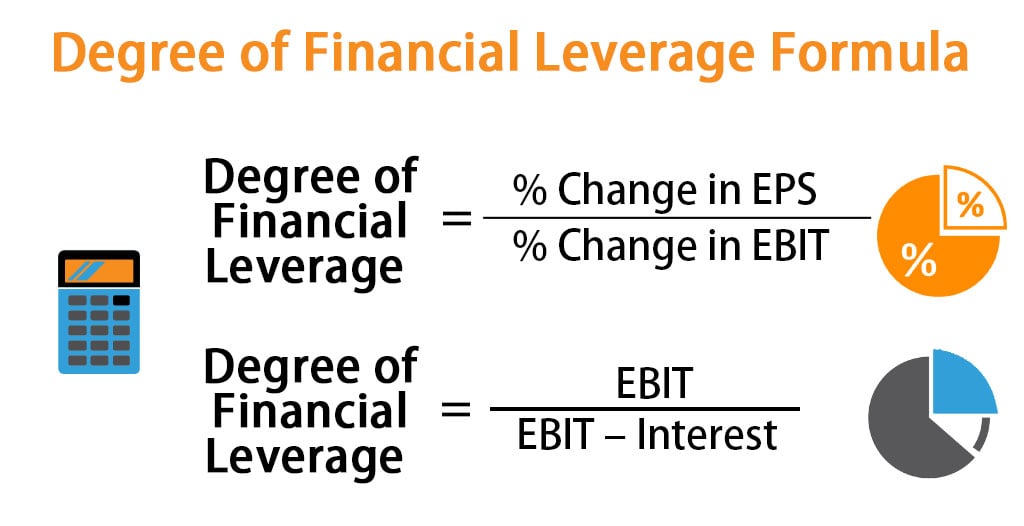

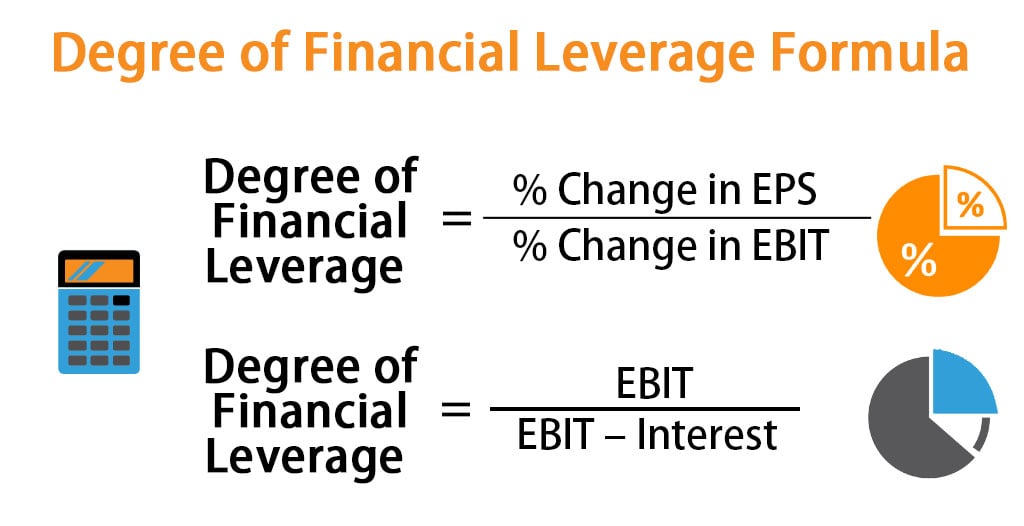

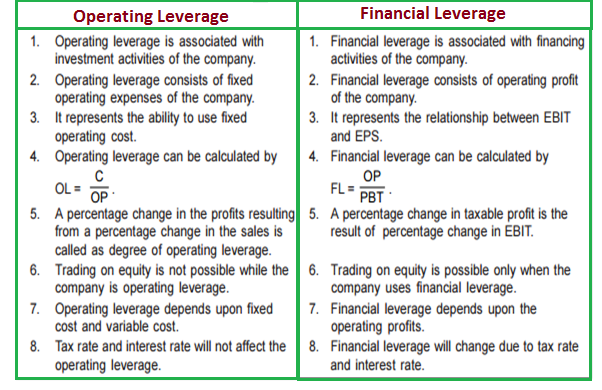

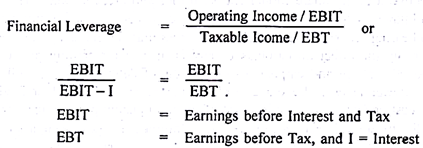

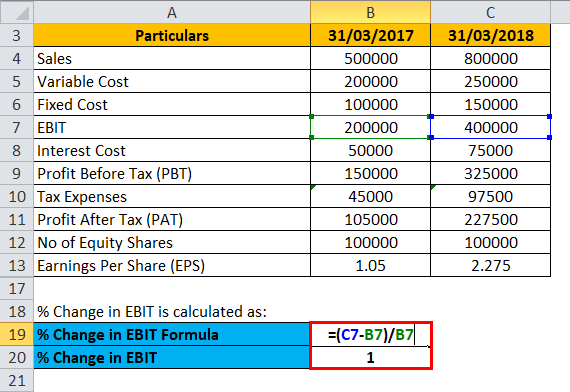

Financial leverage change in earning per share change in earning before interest and tax. Definition of Financial Leverage Financial leverage which is also known as leverage or trading on equity refers to the use of debt to acquire additional assets. It is an important element of a firms financial policy.

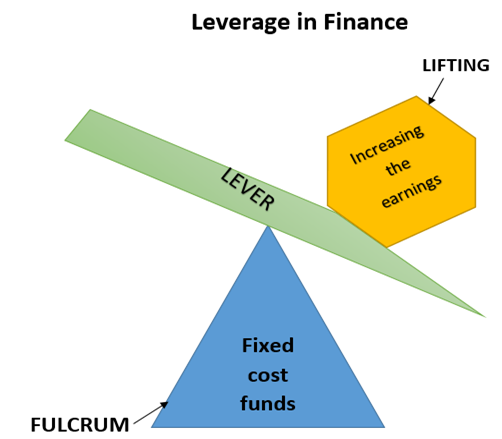

Leverage is an investment strategy of using borrowed moneyspecifically the use of various financial instruments or borrowed capital to increase the potential return of an investment. However businesses also make use of this ratio. Financial leverage means the use of preference share capital equity share capital along with fixed interest bearing securities or debentures.

However an excessive amount of financial leverage increases the risk of failure since it becomes more difficult to repay debt. Financial leverage can also mean the use of company financial resources at a fixed charge. Degree of financial leverage DFL is a ratio that measures the sensitivity of a companys earnings per share EPS to fluctuations in its operating income as a result of changes in its capital.

According to Gitman financial leverage is the ability of a firm to use fixed financial charges to magnify the effects of changes in EBIT on firms earnings per share. It helps to know financial risk pertaining to the company. Financial leverage is the use of debt to acquire assets.

For calculation you have to measure the ratio of total debt with a ratio of total assets. It helps in Taxation by reducing the net cost of borrowing as interest expense is tax deductible. It may be positive or negative.

It can be both good and bad for a business depending on the situation. As leverage goes up so does the risk of failure as it becomes more difficult to repay the debt. Financial leverage is used to improve the companys production earning and overall sales with the help of borrowed money.

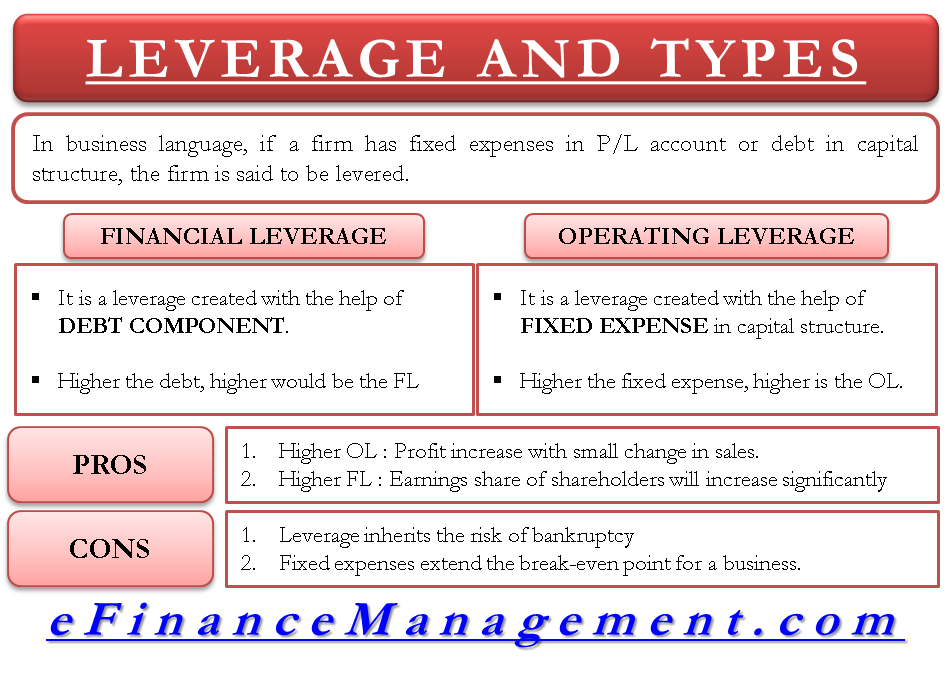

Financial leverage is a story of assets and their returns on one side and the way the assets are financed on the other side. Financial Leverage FL It is a leverage created with the help of debt component in the capital structure of a company. It is a point worth noting that though the OL is low break-even happens quickly still the company is playing safe by taking fewer loans.

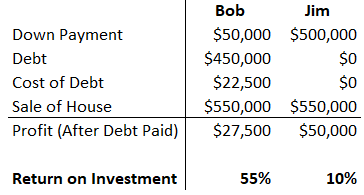

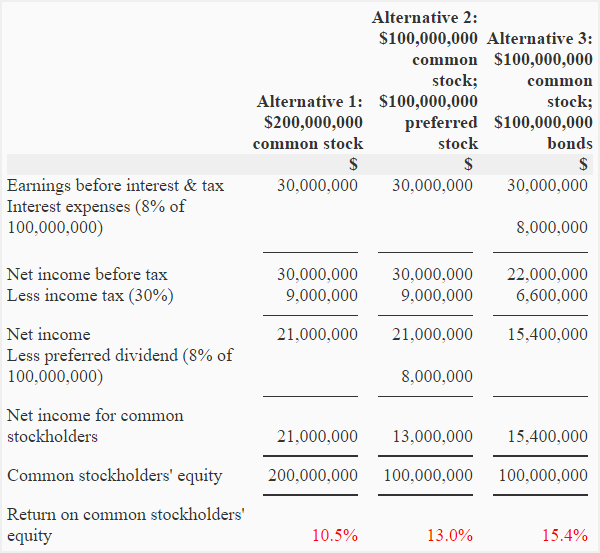

What is Financial Leverage Financial leverage is when a company or investor uses debt to purchase an asset because they expect the asset to earn income or rise in value. Leverage is employed to increase the return on equity. Financial leverage or only leverage means acquiring assets with the funds provided by creditors and preferred stockholders for the benefit of common stockholders.

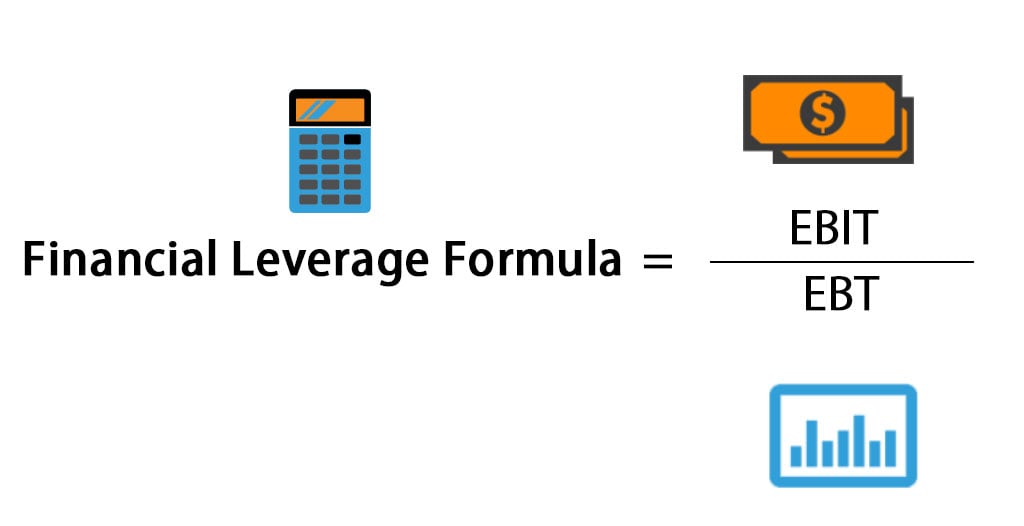

The formula for financial leverage FL says FL will be low when the interest load of the company is low. Its often used by banking institutions to track finances. Leverage is one of the more interesting and difficult concepts to fully grasp in all of finance but its important for anyone that borrows or plans to borrow money to understand.

The financial leverage formula is measured as the ratio of total debt to total assets. What is financial leverage. Financial leverage is used in corporate capital structuring.

When a business cannot afford to purchase assets on its own it can opt to use financial leverage which is. Higher the debt higher would be the FL because with higher debt comes the higher amount of interest that needs to be paid. The following paragraphs explain what is positive and what is negative financial leverage.

The use of financial leverage to control a greater amount of assets by borrowing money will cause the returns. Leverage ratio refers to the proportion of debt compared to equity or capital. It is also called trading on equity.

Financial leverage is the use of borrowed money debt to finance the purchase of assets with the expectation that the income or capital gain from the new asset will exceed the cost of borrowing. In other words financial leverage involves the use of funds obtained at a fixed cost in the hope of increasing the return to the equity shareholders. What do you Understand by Financial Leverage.

It means the company is borrowing fewer loans. Financial Leverage also helps in making major decisions for a company.

Financial Leverage Plan Projections

What Is Financial Leverage Definition Factors Measures Example Benefits Limitations The Investors Book

Financial Leverage Explanation Example Accounting For Management

Degree Of Financial Leverage Formula Calculator Excel Template

Financial Leverage Ratio Prepnuggets

Financial And Operating Leverage Leverages In Financial Management

Leverage Guide Examples Formula For Financial Operating Leverage

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Financial Leverage Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-02-53842f4fc058478b8b874decd8e1c8af.jpg)

Use Of Financial Leverage In Corporate Capital Structure

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Leverage Ratios Calculation And Formula Uses Of Leverage Ratios

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Leverage Ratios Definition Examples How To Interpret

Financial Leverage Learn How Financial Leverage Works

Financial And Operating Leverage Leverages In Financial Management

Types Of Leverages Financial Operating And Combined Leverages

Financial Leverage Formula Calculator Excel Template

Leverage Types Financial Operating Advantages And Disadvantages